Introduction

In a 2017 interview, Microsoft founder Bill Gates recommended taxing robots to slow the pace of automation.[1] Funds raised could be used to retrain and provide financial support for displaced workers. Up to 47 per cent of US jobs are at risk because of advancements in artificial intelligence. Low-wage workers currently hold a majority of those at-risk jobs. Therefore, absent policy changes, increased automation is likely to exacerbate income inequality.

While employment changes due to automation are not new, advances in artificial intelligence threaten to eliminate many more jobs than were eliminated historically through automation, and at a much faster pace. Accelerated automation presents two problems: a revenue problem and a human problem. The revenue problem exists because the tax system is designed to tax labour more heavily than capital, as labour is less likely to be able to avoid taxation.[2] Capital investment, on the other hand, is taxed more lightly because capital is mobile and can escape taxation.[3] When capital becomes labour, as in automation, the bottom falls out of the system. The human problem is first that most people need income from working to survive. Some scholars have advocated for a governmentally provided universal basic income (UBI). Taxing robots could, in theory, provide revenue for a UBI, although any source of revenue would work just as well. While a UBI would solve the survival problem, humans need more than basic survival. In his classic work, psychologist Abraham Maslow listed survival as the foundation of his hierarchy of needs.[4] Work satisfies the higher order needs of social identity and self-esteem.

Of course, automation is not all bad. It has relieved humans of back-breaking (and sometimes boring) work. Moreover, automation can have environmental benefits. Automation is already having an impact on the overall efficiency of the goods-movement system, cutting both costs and energy demands. For example, self-driving vehicles may put human truck and taxi drivers out of work, but could reduce greenhouse gas emissions from transport, which are significant.[5] Automation could deliver 10 to 20 per cent in fuel savings by maintaining optimal speed and avoiding excessive stop-and-go or idling.[6] Thus, policies need to be sensitively designed to assist human workers without stifling automation’s benefits.

When considering how to tax job-replacing robots, we should think about the broader purpose of a tax system. Taxes raise revenue, but for whom? In the context of the United States, the informal title of the most recent tax bill gives a clue: the Tax Cuts and Jobs Act (TCJA).[7] The chairman of the House Ways & Means Committee, Paul Ryan, said the legislation was about “[m]ore jobs, fairer taxes, and bigger paychecks. Faster growth and real upward mobility. A strong economy that makes all of us stronger.”[8] At least in terms of political rhetoric, the tax system serves people. Indeed, in the words of a scholar espousing the utilitarian view of tax policy, “improving aggregate social welfare, as measured by the individual utility levels or happiness of the population, remains one important goal of tax policy.”[9] British philosopher Jeremy Bentham is considered the father of utilitarianism.[10] He was the first philosopher to define the ethics of utilitarianism, under which an action is deemed ethical if it promotes pleasure and diminishes pain. Economic growth does not always increase happiness, particularly in unequal societies.[11] Increasing the wealth of the already wealthy will not increase happiness, although it might decrease happiness for the stagnating middle class who find themselves falling further behind. British researchers Andrew E. Clark and Andrew J. Oswald found (unsurprisingly) that unemployment diminishes happiness.[12] Therefore, if the US tax system exists to serve the American people, it should not lead to unemployment.

The TCJA significantly cut the US corporate tax rate, from 35 per cent to 21 per cent.[13] Economic modeling by the conservative leaning Tax Foundation found that cutting the corporate tax rate to 20 per cent would have the effect of lifting wages by more than 2.5 per cent and creating more than 587,000 full-time equivalent jobs.[14] Combining the corporate rate cut with full expensing for capital investments, which would include the purchase of robots, would increase the number of jobs created to 861,000.[15] However, when White House economic adviser Gary Cohn asked a group of corporate executives whether they would use the tax cut to increase investment, hire employees, or increase wages, there was little positive response.[16]

While the policymakers behind the corporate tax rate cut may have hoped that jobs would result, strings could have been attached to make sure that jobs were created. Instead, the TCJA increased tax benefits for purchasing equipment (which would include automation) by significantly enhancing bonus depreciation.[17] Thus, instead of creating jobs for people, the new tax legislation continued and deepened the existing tax bias toward automation. Employers will obviously be tempted by the tax savings provided by using automation instead of human employees. In addition, from an employer’s perspective, robots have certain advantages over humans. They don’t call in sick, they don’t have affairs with other employees, and they don’t need a retirement plan.[18]

What is to be done with workers whose jobs are made obsolete by automation? Retraining is an obvious answer. Although many jobs can be automated, some jobs are, at this time, unlikely to be fully automated. Manual non-routine jobs, such as caregiving for small children or the elderly is not likely to be automated, but not all people whose jobs have been eliminated by automation are suited to such work. However, some of those people who are not suited for caregiving might be able to do construction work. According to the McKinsey Global Insight report, jobs involving physical activities in an unpredictable environment, such as forestry or construction, require a high degree of flexibility, which makes them harder to automate.[19]

The TCJA not only made it less attractive to hire human workers, it made it more difficult for human workers to find new jobs. First, the TCJA eliminated the moving expense deduction, which made it easier for workers to move to take another job.[20] Second, the legislation eliminated the miscellaneous itemized deduction for unreimbursed employee business expenses, which employees could use to defray the cost of self-funded retraining.[21] Rather than “hoping” that tax cuts would create jobs, policymakers could act to provide meaningful work opportunities and to incentivize private employers to use humans, rather than robots.

This article will first define “robot”, then explore the history and future of automation. Next, the article will examine the history and future of tax provisions that affect job availability and the taxation of capital and labour in the United States. This section will include the rationale for taxing capital more lightly than labour, and for comparing the burden of labour taxation in other developed countries to labour taxation in the United States. This section will further consider whether robots should be taxed as capital, as well as the broader question of whether the current taxation of capital is normatively wrong, based on philosophical rationale and taking into account capital taxation’s impact on inequality. The focus of the article follows by asking why humans need jobs and exploring policy options for solving the “jobs” problem. This section will include a discussion and critique of UBI proposals and recommend other policy options, such as an enhanced earned income tax credit, incentives for employers, and reviving an idea from the Great Depression, the Civilian Conservation Corps. Finally, the article concludes that while tax changes benefitting displaced workers should be pursued, taxing robots is probably not the best option for funding those changes.

I. History and Future of Automation

I regard it as the major domestic challenge … of the ‘60s, to maintain full employment … when automation … is replacing men.[22]

Clearly, concern about automation is not a new problem. Well before President John F. Kennedy worried about job replacement by automation in the 1960s, in 1811, at the peak of the Industrial Revolution, a group of textile workers calling themselves Luddites smashed machinery to protest working conditions.[23] Although many in the group were in fact skilled machine operators, the term “Luddite” has come to represent resistance to modern technology. Bill Gates—the founder of one of the world’s most successful technology companies—is no Luddite, but even he has expressed concern about robots taking the jobs of humans who paid taxes.[24] His focus is not so much on keeping humans in those jobs, but on retaining the government income tax revenue that once came from human workers. Gates wants a robot tax to pay for humans doing the jobs that humans are best at: those requiring human empathy and understanding, like reaching out to the elderly and helping special needs children. He notes that there is an “immense” shortage of people doing those jobs that are uniquely human.[25] Before you can tax a robot, however, you have to decide what a robot is. The next part considers definitions.

A. Defining Robots

The idea of a “robot” has been exemplified in modern culture in such fictional characters as Class B-9-M-3 General Utility Non-Theorizing Environmental Control Robot, known simply as Robot, from the TV series Lost in Space; Rosie the Robot maid from the Jetsons animated series; R2-D2 from Star Wars; and the Waste Allocation Load Lifter Earth-class WALL-E, from the 2008 Disney-Pixar film WALL-E. All of these robots have humanoid features like arms or eyes and move while in an erect position, somewhat like a human. For the purposes of this article, which focuses on the revenue and jobs aspects of robots, a robot is any machine that can duplicate human skills. Those skills may be physical or mental. We may use the term “automation” interchangeably with “robot”, as automation means using machines to perform tasks that might be performed by a human, and even some tasks that humans would find difficult to perform. Some robots may be capable of learning, also called artificial intelligence or machine learning. Machine learning occurs via algorithms programmed into the machine that enable it to “learn”, either from previous experience or experiences accessible through a data source.[26]

B. History of Automation

Automation has been used to replace human labour for centuries. Historically, automation was used to replace physical skills—a non-human power source using tools to perform a task. The history of automation can be illustrated by looking at three sectors of the job market: agriculture, industry, and services. When humans first began cultivating crops between 12,000 and 23,000 years ago, humans were the only source of labour.[27] The Romans documented the use of oxen to plow fields in the first century A.D.[28] The ancient Greeks made the first recorded use of water wheels to mill grain.[29] The natural movement of water in a stream provided the power source that moved the grinding stones. In 1794, Eli Whitney patented the cotton gin, which separated seeds from the valuable cotton fibers, replacing fifty human labourers with one machine and a horse.[30]

Automation ushered in the Industrial Revolution with the invention of the steam engine in England.[31] The steam engine provided cheap energy, enabling the British economy to increase annual growth from 1 per cent per year to 4 per cent per year, making Britain the foremost economic power in Europe.[32] In 1913, Henry Ford installed the first moving assembly line in the United States, which facilitated the future of automated manufacturing, although the original assembly line workers were humans.[33]

The Industrial Revolution caused a shift in employment—before that, a majority of people worked in agriculture. The US Bureau of Labor Statistics tracked the shift—in 1850, 64.5 per cent of workers were employed in agriculture.[34] In 1910, work was almost evenly divided between the agriculture, industrial, and service economies.[35] In 2016, 2 per cent of those employed worked in agriculture, 13 per cent worked in industry, and 80 per cent worked in the service sector.[36] The United States lost about 5.6 million manufacturing jobs between 2000 and 2010.[37] There is some dispute about the reason for the decline in industrial jobs in the United States. Analysis by researchers at the University of Michigan examined multinational corporations and found that increased foreign sourcing—in other words “globalization”—to be a “strong substitute” for US employment.[38] Researchers at Ball State University found that 88 per cent of the job loss was due to increased productivity from technological improvements.[39] Another study blamed robots for 360,000 to 670,000 lost manufacturing jobs between 1990 and 2007.[40] The Brookings Institution warned “don’t blame the robots,” reporting that countries that invested in robots saw lower declines in manufacturing employment.[41] Germany, Sweden, Korea, France, and Italy all lost fewer jobs than the United States despite greater investment in robots.[42] In particular, Germany, which uses over three times as many robots per hour as the US, lost 19 per cent of manufacturing jobs from 1996 to 2012, compared to 33 per cent of manufacturing jobs lost in the US.[43]

The automotive industry continues to move toward reducing human labour and increasing robot labour, leading to increased productivity. For example, in the 1950s, each General Motors (GM) employee made an average of seven cars per year.[44] Now each employee makes twenty-eight cars per year, meaning that today GM needs four times fewer workers per car produced.[45] In 2017, Elon Musk of Tesla Motors, announced plans for a fully automated automobile factory with no humans on the floor.[46] However, in 2018, Mr. Musk acknowledged that his dream of full automation in the Model 3 factory was to blame for failure to meet production goals, tweeting “Yes, excessive automation at Tesla was a mistake. … Humans are underrated.”[47]

Finally, “intelligent” computers like the chess-playing Deep Blue[48] and the Jeopardy-playing Watson[49] herald the future potential of robots. While computers like Deep Blue and Watson don’t move around like R2-D2, their vast computing power allows them to almost instantaneously review and analyze huge amounts of data, leading to applications in medical diagnoses[50] and legal document review.[51]

C. Future of Automation

Historically, automation has created jobs, and some wonder why today’s automation is different. Indeed, some argue that today’s automation is no different, and that the rise of machine learning and artificial intelligence will not cause any aggregate job loss.[52] A report from McKinsey Global Initiative came to a similar conclusion, citing an executive survey that found that about 77 per cent of companies responding to the survey expected no net change in numbers of workers from adopting automation and artificial intelligence (AI).[53] However, many economists and technology experts believe that broad implementation of AI will substantially accelerate in the near future, causing rapid job loss.[54] The annual worldwide shipments of multipurpose industrial robots are projected to almost double from 2014 to 2019, from around 200,000 units to over 400,000 units.[55] Human skills may not be able to keep up with the pace of technological change, thereby creating technological unemployment.[56] Moreover, robot labour may be less costly than human labour. For example, a human welder today earns an average of twenty-one dollars per hour,[57] while “the equivalent operating cost per hour for a robot is around eight dollars.”[58]

Even those researchers skeptical of the job-loss potential of today’s automation recognize that the structural dislocation from the increased pace of technological change exacerbates income inequality and results in the need for policy changes. As Borland and Coelli note:

Technological change does not have a long-run effect on aggregate employment because, although it may cause jobs to be destroyed, it has also always meant the creation of extra and new jobs. … Clearly, technological change does affect the labour market. Some workers lose their jobs, and this creates the need for policies to assist those workers to regain employment. … [C]hanges in the distribution of and return to employment across occupations, which seem likely to have been driven to a large degree by developments in technology, have been a major cause of increasing earnings inequality.[59]

The Organisation for Economic Cooperation and Development (OECD), in its 2016 analysis, agreed with the above conclusion. While finding that automation is unlikely to destroy large numbers of jobs, the report notes that “low qualified workers are likely to bear the brunt of the adjustment costs.”[60] The report found that no country had more than 15 per cent of workers in jobs with high automatability, and only the United Kingdom, Slovak Republic, Spain, Germany, and Austria had more than 10 per cent of workers in this at-risk category.[61] However, in all countries, the jobs at most risk are low-skilled and require little education.[62] The McKinsey Global Institute report cited above found job losses were likely to occur in physical and manual work, such as equipment operation and navigation, as well as basic cognitive work, such as basic data input and communication.[63] Increased demand was likely to be found for employees with higher cognitive skills, such as creativity, and social and emotional skills, such as leadership and management.[64]

In 2015, an article in The Atlantic predicted the “end of work”, citing three reasons to believe that automation will begin to reduce the overall supply of jobs: “the ongoing triumph of capital over labor, the quiet demise of the working man, and the impressive dexterity of information technology.”[65] Although unemployment rates are near historic lows in the United States, the Department of Labor only measures those still seeking work in calculating unemployment.[66] The 1.4 million people who are no longer seeking work do not factor into those statistics, which only count people who have searched for work in the four weeks before the statistic is generated.[67] Although unemployment rates are declining, the number of long-term unemployed and discouraged workers remain about the same.[68] Interestingly, job gains have occurred in some of the categories considered most vulnerable to automation, such as warehousing and transportation.[69] The Bureau of Labor Statistics reported that while the unemployment rates declined for adult women and “whites”, the unemployment rates for adult men, teenagers, and minority groups remained unchanged from the last reporting period.[70]

As important in assessing the impact of automation as the unemployment rate is the “labour share” of the economy. The labour share of the economy is defined as the share of gross domestic product (GDP) that is paid as compensation in the form of wages, salaries, pensions and other benefits.[71] Economists use labour share to determine the distribution of income between labour and capital.[72] The labour share of advanced economies has declined from 54 per cent in 1980 to 51 per cent in 2014.[73] About half the decline in the labour share results from technology adoption.[74] For example, in 1964, AT&T was the most valuable company in the US, employed 758,611 people and was worth $267 billion in today’s dollars.[75] In 2017, Google (Alphabet), was worth $762.5 billion but reported having about 88,000 employees—three times the market value of 1960s AT&T but only about 10 per cent of the work force.[76]

AI poses the most significant problem for human jobs. When automation replaced human physical skills, humans could still rely on their superior cognitive skills.[77] AI threatens to replace humans’ cognitive skills. Robots and computers are unlikely to develop human consciousness or emotions. However, for the first time, “humans are in danger of losing their economic value because intelligence is decoupling from consciousness.”[78] Optimistically, “even as A.I. threatens to put people out of work, it can simultaneously be used to match them to good middle-class jobs that are going unfilled.”[79] Moreover, AI may be able to predict which skills and training will be needed for the job openings of tomorrow.[80] The importance of continuous learning in today’s environment of rapid technological innovation cannot be overemphasized. While humans have traditionally viewed education as a period of learning followed by a period of working, soon this traditional model may become obsolete, and the only way for humans to have relevant job skills will be to keep learning throughout their lives.[81]

As the next part will illustrate, taxes related to human labour form the bulk of US federal revenues. Among other issues, the potential demise of human work creates a revenue problem for government. Government should be thinking about solutions.

II. The US Tax System’s Impact on Employment

A. Where Revenues Come From

Until 1940, the US government obtained its revenues primarily from tariffs and excise taxes.[82] The US Constitution created a barrier to other taxes by imposing both a uniformity requirement and an apportionment requirement.[83] After the Supreme Court struck down a tax on rents from property in Pollock v. Farmers’ Loan & Trust Co.[84] as unconstitutional, a movement began which eventually led to the adoption of the 16th Amendment, enabling Congress to enact income taxes without regard to the unmanageable apportionment requirement.[85] However, income taxes remained low and primarily affected the wealthiest Americans until World War II. Need for revenue to fund the war effort transformed the income tax from a “class tax” to a “mass tax”.

Today, over half the revenues collected by the federal government come from the individual income tax and payroll taxes, as illustrated by the chart below.[86] If individuals do not earn income, they do not pay tax, leading to the concern expressed by Bill Gates: automation of labour will affect government revenues.

Of course, corporations and business owners that employ robots may make profits and pay taxes on those profits. However, as the next part describes, business profits and income derived from those profits, such as dividends and capital gains, bear a lower tax burden than earnings from human labour.

B. Why Tax Capital More Lightly Than Labour?

“Taxing capital income” refers to the taxation of returns from investment of money. The classic economics literature concluded that the most efficient rate for taxation of capital income is zero.[87] This is because “[i]n public economics the conventional wisdom has been that taxes on capital income generate high efficiency costs with few offsetting benefits.”[88] Efficiency is one of the three oft-cited policy goals for the tax system, along with equity and simplicity.[89] Efficient taxation means that taxes can be collected without stimulating evasive behaviour or changing business decisions, known in economics terms as “minimizing distortions”.[90] Capital is “mobile”, that is, it can move off-shore and away from the taxing authority with relative ease—much more easily than a human can.[91] Another argument for not taxing capital is that taxing capital discourages savings.[92]

However, capital is taxed in the United States and many other countries, albeit at a lower rate than labour income. Economists James Banks and Peter Diamond argue that the conventional conclusion that capital should not be taxed arises from limitations in the models—the economic models do not take into account individuals’ tendency to smooth consumption over time and also the ability of some individuals to convert labour income into capital income.[93] They conclude that capital income should be taxed, although not necessarily at the same rate as labour income. Professor Edward Kleinbard supports the concept of a dual income tax, based on the Nordic model, which would retain a tax on capital income at a lower rate than labour income.[94] The Mirrlees Review of the United Kingdom tax system advised that “[i]ncome from all sources should be taxed according to the same [progressive] rate schedule.”[95] The Review also recommended taxing corporate income, but reducing the personal taxes paid on dividends to result in a tax rate on the combined income equal to the tax rates applied to income generally.[96] Economists generally view the taxes on corporations to be borne by capital.[97]

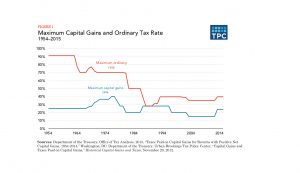

Taxpayers who receive income from capital benefit in several ways from the US tax system. First, while income from labour is taxed currently as it is earned each year, income from capital appreciation may be deferred until the asset is sold. This is known as the realization principle and constitutes a significant portion of the benefits enjoyed by capital income.[98] Furthermore, if the asset is held until the death of the owner, its increase in value may escape taxation entirely.[99] Second, when taxed, income from capital enjoys lower rates. In the US, capital gains have historically been taxed at a lower rate than “ordinary” income, as illustrated by the chart below.[100] Ordinary income refers to all income other than capital gains and dividends. Capital gains are defined as gain from the sale or exchange of a capital asset.[101] Capital assets are a broad category, defined by excluding certain assets.[102]

Business profits are generally taxed as ordinary income and do not directly benefit from lower capital gains rates. However, taxpayers who receive business profits benefit in several ways from the US tax system. First, dividends paid to corporate business owners are taxed at the capital gains rate.[103] Second, while the definition of capital asset excludes assets used in a trade or business, another provision frequently allows the lower capital gains rate to apply to the sale of such assets.[104] Finally, businesses enjoy many deductions not allowed to employees, and the list of deductions that employees cannot use has gotten longer after the 2017 tax legislation.[105]

In the context of robot taxation, these elements of the tax system raise several issues. Are robots capital or labour? If robots are labour, then they should be classified and taxed as labour. However, another possibility is that the current taxation of capital is not optimal. High labour taxes have been blamed for unemployment in developed countries.[106] An analysis of “tax wedges” (which measure the burden of tax and social security contributions relative to labour cost) in OECD countries found that the larger the tax burden on labour, the higher the unemployment rate.[107] Changing the taxation of capital to make it more like the taxation of labour would also solve the robot tax problem in two ways. First, taxing capital at the higher rates faced by labour would increase revenue. Second, taxing capital at the same rate as labour would remove the tax induced preference for capital investment—which includes investment in robots.

This section has outlined how the tax preference for capital investments contributes to the loss of tax revenue from automation. The next part will explain how the recent changes to the US tax system, rather than solving the problems, have exacerbated it. The US tax system is now even less generous to human workers.

C. Recent Changes in the US Tax System

The 2017 tax legislation resulted in the most significant changes to the US tax system in thirty years.[108] While opinions about the tax bill varied along predictable political lines, the legislation clearly took a “business-centric” approach.[109] The following discussion will explain how capital (which includes investments in robots) wins and labour loses under the legislative changes in the TCJA.

1. Capital Wins

The corporate income tax rate cut, from 35 per cent to 21 per cent, is a win for capital.[110] In 2017, before the legislative change, over 90 per cent of the benefit of lower tax rates on capital gains and dividends accrued to the top 20 per cent of the income distribution, with 73 per cent of that benefit going to the top 1 per cent.[111] Before the new legislation, the top combined tax rate on corporate income and dividends was 50.47 per cent.[112] After the corporate rate cut, the top combined tax rate on corporate income and dividends is 39.8 per cent.[113] Viewed in a different way, if a corporation earned one hundred dollars, paid taxes and distributed the remainder to shareholders, before the tax legislation, the shareholders would get a little less than fifty dollars. After the tax legislation, the shareholders would get more than sixty dollars. Thus, people with capital to invest will benefit from the corporate income tax rate cut.

a. Who Benefits from the Corporate Rate Cut?

Although the corporate tax is levied on corporations (known in economic terms as incidence), corporations are fictional entities and will shift that burden on to someone else. The burden of the corporate tax must be borne by people, and there are limited choices. Stockholders or employees are the top candidates, with customers or suppliers also potentially affected. When extolling the virtues of the corporate tax cut, advocates argue that employees bear the burden of the corporate tax and predict that lifting that burden will result in more employment and higher wages.[114] After the enactment of the corporate tax rate cuts, some corporations have increased wages and others have paid bonuses to employees,[115] although it is not clear whether these actions are due to the corporate tax cut or the low unemployment rate.

However, a majority of economists believe that most of the burden of the corporate tax falls on shareholders, and therefore shareholders reap most of the benefit from corporate rate cuts.[116] One report predicts that corporations will return $1.2 trillion to shareholders via stock buybacks and dividends.[117] When corporations purchase their own stock, the shareholders who have their stock purchased get cash, and the other shareholders get an increased ownership interest in the company. Again, capital wins.[118] Even former Republican presidential hopeful Senator Marco Rubio doubts that the corporate tax cuts will help American workers.[119]

b. Accelerated Benefits from Capital Investment

The TCJA also increases the ability of businesses to expense the cost of capital equipment, in contradiction of the matching principle. The matching principle in accounting holds that deductions should be “matched” with the income generated by the expense. The Internal Revenue Code (IRC) disallows deductions for “capital expenditures”.[120] Instead, capital expenditures may be depreciated and deductions taken over the life of the asset.[121] The life of a class of assets is either defined in the IRC, in Treasury regulations, or by the Internal Revenue Service (IRS), and is technically known as the “recovery period”. However, as a general rule, the IRC allows accelerated depreciation deductions, with the so-called double-declining balance method being the default method for most assets. The TCJA provides for 100 per cent bonus depreciation for qualified property acquired through 2023. Qualified property is defined as tangible personal property with a recovery period of less than twenty years. Robotic equipment generally has a recovery period of five years, and would qualify for the 100 per cent bonus depreciation, which in effect allows for a full deduction of the cost of the robot. Contrast this tax benefit with the cost to a business of a human worker. The wages of the human worker may be deducted each year by the business, but the robot will last for (at least) five years. Assume that the human worker receives $50,000 in wages each year and the robot costs $250,000. The business will save $8,085 in taxes by deducting the $250,000 in year one in comparison to the deduction of $50,000 human worker wages each year for five years.[122] If the robot can replace several human workers, that provides additional savings for the business.

The foregoing discussion illustrates that capital investment benefits from the tax law changes in the TCJA. Not only does capital win, but labour loses, as will be shown by the following discussion.

2. Labour Loses

a. The “Pass-Through” Deduction

The TCJA not only reduced the corporate tax rate, but also provided a new tax benefit for businesses that do not operate in corporate form. The “pass-through” deduction allows individual business owners to exclude 20 per cent of qualified business income from their taxable income.[123] The details of this provision are complex and beyond the scope of this article, but the pertinent fact is that employees cannot benefit from this deduction.[124] Moreover, business owners whose business provides personal services like accounting or legal services have very limited benefits from this deduction. However, the amount of the deduction may be calculated in part by the wages paid by the business owner, so that may encourage hiring human employees. Economist Patrick Driessen suggests that the pass-through deduction could be refined to encourage employment. Currently codified at section 199A, he suggests adding section 199L (“L” for “labour”), structured as a wage credit.[125] Driessen critiques the pass-through deduction, calling it “a narrow labor and arguably unneeded capital subsidy.”[126] The other way of calculating the deduction is by the cost of business assets, which would include robots.

b. Moving Expense Deduction

One might argue that workers who lost jobs due to automation could simply find the new jobs created by technology. However, the new jobs created by technology are not in the places that are losing jobs.[127] Economist Enrico Moretti explored this issue in his book The New Geography of Jobs, noting that inequality in America is not only between the privileged and educated and underprivileged and uneducated, but is also impacted by geography.[128] Moretti states:

Technological change and globalization result in more employment opportunities for a low-skilled worker in a high-tech hub but fewer opportunities for a similar worker in a hollowed-out manufacturing town. What divides America today is not just socioeconomic status but also geography.[129]

Unfortunately, the TCJA made moving more difficult for workers. Congress paid for the corporate tax cuts and other business tax benefits by reducing individual income tax deductions. Before 2018, the moving expense deduction allowed workers who moved more than fifty miles to a new job to deduct moving costs “above the line”.[130] The moving expense deduction was repealed in the TCJA. The repeal of the moving expense deduction was estimated to raise $7.6 billion over ten years, not much in the context of tax legislation that would reduce overall tax revenues by an estimated $1.5 trillion.[131] But the loss of the moving expense deduction could be a significant barrier for a human worker who might otherwise find employment in a new city. The average cost of moving within the United States in 2014 was over $12,000.[132] The high cost of moving perhaps explains why Americans with low educational attainment move less often than college graduates, and the loss of the moving expense deduction will certainly not improve that trend.[133] There is some evidence for another factor: one study found that “for less educated workers, opportunities do not vary much across different local markets, whereas for college-educated workers, different markets offer different opportunities.”[134] This study concluded that this “spatial dispersion” of labour income accounts for most of the educational differences in mobility.[135] The interaction between wages, mobility, and education highlights another change to tax benefits—those for education.

c. Education Expenses

Education is the main driver of wage inequality, and the “college premium”—which refers to the wage gap between those with high school and college educations—has more than doubled since 1980.[136] In 1979, holders of bachelor’s degrees could expect to earn 134 per cent of the wages received by those with only a high school education, and holders of graduate degrees could expect to earn 154 per cent. By 2016, these wage premiums had significantly increased—to 168 per cent for a bachelor’s degree and to 213 per cent for a graduate degree.[137]

If a human worker’s job is replaced by a robot, the human worker could return to school to seek retraining. Even better, the human worker could anticipate the job loss and return to school before losing the job. Under certain circumstances, the cost of education is deductible. IRC section162 allows a deduction for ordinary and necessary expenses paid or incurred in carrying on a trade or business.[138] Treasury regulation section 1.162-5 explains which education expenses may be eligible for the deduction.[139] The education expense must be for improving skills in the taxpayer’s current employment or trade or business. However, if the education leads to a new trade or business, the cost is not deductible. This rule is consistent with the underlying policy and language of section 162—the expenses must be incurred in “carrying on” a trade or business. The cost of developing a new business is considered a non-deductible capital expenditure.[140]

As noted above, a current employee might want to enhance her skills in her current occupation so that she could be more marketable in the face of potential automation. However, her employer might not want to reimburse her for the cost of training. Unreimbursed employee business expenses are miscellaneous itemized deductions.[141] Before 2018, miscellaneous itemized deductions were limited—a taxpayer could only deduct the amount that exceeded 2 per cent of the taxpayer’s adjusted gross income.[142] However, after 2018, those expenses are simply not deductible at all.[143]

The IRC provides tax credits for certain costs of obtaining higher education. These credits have not been repealed by the TCJA. The American Opportunity Tax Credit (AOTC) provides an offset from tax liability of $2,500 per eligible student, which includes the spouse or dependents of the taxpayer.[144] Up to $1,000 of the credit is refundable. It is only available for the first four years of higher education per student, and eligibility ends when the student completes the first four years of postsecondary education before the end of the tax year. Eligible students must be enrolled at least half-time for at least one academic period and must be pursuing a program leading to a degree or other recognized credential. Unlike the business deduction described in the previous paragraph, due to the half-time enrollment requirement, the AOTC doesn’t help students who work full-time and take a class at night to develop their skills or finish a degree. Almost 9.7 million taxpayers claimed the credit in the most recent year for which IRS tax data is available, and the total savings exceeded $22 billion. The average savings per family for claiming the credit was of $2,277.[145]

The other education tax credit is the Lifetime Learning tax credit, which provides an offset from tax liability of 20 per cent of up to $10,000 in qualified education expenses paid for all eligible students included on the taxpayer’s tax return, for a maximum credit of $2,000.[146] There is no limit on the number of years the lifetime learning credit can be claimed, and the student does not have to enroll in a minimum number of hours to claim the credit. The Lifetime Learning tax credit contains no refundable element, so taxpayers must have tax liability to benefit from this credit.

To be clear, research has not shown that the education tax credits increase college attendance, for various reasons mostly related to the design of the credits.[147] Tax credits reduce tax liability, and therefore taxpayers do not see the benefits until filing their tax returns months after paying tuition. Thus, the tax credits do not remove barriers to liquidity in education financing. However, the tax credits do reduce the cost of attending college for those who can benefit from them and arguably provide greater benefits to society than their cost. As noted in a Treasury Department analysis of education tax credits, “[p]ositive spillovers from education include increased economic growth that benefits less educated workers, lower crime rates, greater civic participation, better political decisions as a result of a literate electorate, and higher rates of volunteerism.”[148]

The conclusion of the foregoing discussion is that capital wins and labour loses from the recent changes to the US tax system. Cuts to the corporate tax rate and tax benefits for investment under the TCJA make capital the winner. The TCJA’s temporary repeal of deductions that could be used by workers make labour the loser. The next section will further explore the ethical underpinnings of the tax system, and their relationship to labour well-being.

D. Philosophical Basis for Taxation

The rhetoric of economics dominates tax policy discussions, and a key economic theory, optimal tax theory, is based on utilitarianism.[149] In her excellent article, Jennifer Bird-Pollan explained the economic philosophy of the originator of “modern” utilitarianism, Jeremy Bentham.[150] Bentham’s theory was based on the idea of evaluating policy by measuring it in terms of human happiness. Bentham was a consequentialist thinker, reasoning that as actions have consequences in the real world, ethical analysis must begin with real world facts.[151] Under Bentham’s utilitarian theory, “an action is deemed ethical if it promotes pleasure and diminishes pain.”[152] David Weisbach explicitly linked utilitarian theory to happiness studies.[153] Weisbach assumes that measuring the impact of taxation on human happiness is a valid consideration.[154]

Psychology researchers are less squeamish about measuring human happiness than economists.[155] In a large-scale survey in Great Britain, researchers found that the unemployed are unhappy and that “being unemployed is worse, in terms of lost ‘utility’ units, than divorce or marital separation.”[156] If the tax system encourages automation and discourages human workers, leading to unemployment, then the tax system is a cause of unhappiness and therefore fails to produce utility.

There is another link between the tax system and this problem of unemployment and unhappiness. One of the researchers from the British survey cited above, Andrew Oswald, found a strong correlation between home ownership and unemployment.[157] Because home owners are less likely to move to find a new job, home owners who lose their jobs may have limited success in finding new employment, and if they do they are more often subject to the stress of a long commute.[158] The tax system has long encouraged homeownership, which could be viewed as counterproductive. In an earlier article, I concluded that, in light of Professor Oswald’s research, it is fair to say that home ownership may make one poor and unhappy.[159] The TCJA retained modified benefits for home ownership, reducing the home mortgage interest deduction to a principal amount of $750,000, down from $1 million, and eliminating the home equity loan interest deduction. However, coupled with the TCJA’s significant increase in the standard deduction, only relatively high-income taxpayers will benefit from the mortgage interest deduction in the future.[160] Those high-income taxpayers are less likely to experience job loss from automation.[161]

Job loss is not just an economic issue, however. Jobs provide not only income, but also social interaction and identity, all of which are critical for a happy life. The next section focuses on why jobs are important for humans.

III. Psychology of Jobs

[W]ork keeps at bay three great evils: boredom, vice and need.[162]

Unemployment has significant mental health consequences. In particular, involuntary unemployment, such as layoffs caused by automation, leads to feelings of helplessness and loss of control.[163] If unemployed workers do not have access to retraining or job placement services, they are likely to become long-term unemployed. Long-term unemployment has consequences not only for those workers affected but also for society at large.[164] The psychological scars from unemployment can persist even after employment is regained.[165] One study found that job loss resulted in “50 to 100 percent increase in death rates the year following the [job loss] and 10 to 15 per cent increases in death rates for the next twenty years.”[166] Children of unemployed workers face increased family stress, lower family incomes, and poorer educational and work outcomes themselves.[167] Neighborhoods with a high population of unemployed workers tend to have higher crime rates.[168]

Several studies find a link between regional unemployment and drug use, some specifically referencing the opioid epidemic.[169] Hollingsworth et al. studied mortality data from the Center for Disease Control and correlated the rise in deaths from overdoses with county level unemployment rates, finding a significant impact.[170] Researchers from the St. Louis Federal Reserve note the National Survey on Drug Use and Health’s findings that between 2005 and 2011, 18 per cent of unemployed persons used illegal drugs, as opposed to only eight per cent of full-time workers.[171] Although the time period examined did include the Great Recession of 2008 to 2009, the researchers found that the result was stable. Anne Case and Angus Deaton found that “deaths of despair”, defined as drug poisoning, alcoholism, and suicide, caused the overall drop in life expectancy in the US. The impact is regional and also related to educational attainment. College educated Americans showed an increase in life expectancy, while those without a college degree showed a decrease in life expectancy. An earlier study by Case and Deaton specifically found that drug overdoses were a significant cause of increased mortality among middle-aged white men.[172] So-called “prime-age” men, between the ages of 24 and 54, constitute an increasing percentage of labor market dropouts.[173]

Of course, these arguments are relevant only if automation has the potential to cause joblessness. At least one study finds empirical support for that premise.[174] However, whether this is true or not, Americans surveyed express significant anxiety about the impact of automation on employment.[175] A Pew Research Center report found that over 70 per cent of Americans (1) express worry about a future in which robots and computers are capable of doing many jobs that are currently done by humans; (2) expect that economic inequality will become much worse if robots and computers are able to perform many of the jobs that are currently done by humans; and (3) anticipate that the economy will not create many new, better-paying jobs for humans if this scenario becomes a reality.[176] Most responding to the survey expect that people will have a hard time finding things to do with their lives if forced to compete with advanced robots and computers for jobs, and an even greater number (85 per cent) are in favor of limiting the use of machines to tasks that are dangerous or unhealthy for humans. The survey also asked about solutions to the robot jobs problem. Sixty per cent support a government funded guaranteed income program and almost as many (58 per cent) would support “a national service program that would pay humans to perform jobs even if machines could do them faster or cheaper.”[177]

These responses reflect a recognition that jobs are more than just a means of providing income, although income is critically important. As Rebecca Rosen wrote in The Atlantic, “the loss of a job is not merely the loss of a paycheck but the loss of a routine, security, and connection to other people.”[178] Of course, not all jobs are created equal. Researchers have developed a framework, called the Psychology of Working Theory (PWT), that defines what makes a “decent” job.[179] Elements of PWT

include:

- Work is an essential aspect of life and an essential component of mental health.

…

- Work includes efforts within the marketplace as well as caregiving work, which is often not sanctioned socially and economically.

- Working has the potential to fulfill three fundamental human needs—the need for survival and power; the need for social connection; and the need for self-determination.[180]

In the United States, a significant proportion of the new jobs that have been developed since the Great Recession qualify as “precarious work”: insecure, often-part-time, and time-limited.[181] These jobs are low-wage positions that are often limited to a circumscribed time period and do not offer benefits. Precarious work is not decent work. The researchers define decent work as containing the following elements:

- Working conditions free from physical, mental, or emotional abuse;

- Working hours that allow for free time and adequate rest;

- Organizational values that complement family and social values;

- Adequate compensation; and

- Access to adequate health care.[182]

The researchers found that “working is essential to human health and well-being.”[183] In particular, decent work will satisfy survival needs, social connection needs, and self-determination needs. While survival needs and social connection needs are relatively self-explanatory, the researchers define self-determination as “the experience of being engaged in activities that are intrinsically or extrinsically motivating in a meaningful and self-regulated fashion.”[184] These elements are important to keep in mind when designing policies to help workers navigate the increasingly automated future. The next section will explore potential solutions to robot-related unemployment.

IV. Potential Solutions

A. Universal Basic Income

A 2016 article in the New York Times directly tied the idea of providing a basic income to workers displaced by robots.[185] Tesla’s Elon Musk believes that providing a UBI will become essential, because “there will be fewer and fewer jobs that a robot cannot do better.”[186] Facebook’s Mark Zuckerberg believes that a UBI could spur innovation.[187] Virgin’s Richard Branson said, “I think with artificial intelligence coming along, there needs to be a basic income.”[188]

The history of UBI goes back to the sixteenth century.[189] From Sir Thomas More (counselor to King Henry VIII of England) to Richard Nixon and beyond, thinkers and policymakers have considered the idea.[190] In The Stakeholder Society, Anne Alstott and Robert Ackerman proposed granting every young adult in the US a lump sum of $80,000 to provide equality of opportunity.[191] The recipients could use the money for education or to start a business, and there would be no strings.[192] While UBI generally means periodic payments rather than lump sums, the idea of no strings attached remains a key element.[193]

Programs like UBI have been discussed by scholars of various political stripes[194] and tried in many places around the world.[195] Programs in Manitoba, Namibia, and India were found to have increased education, reduced medical problems, and increased economic activity, as well as reducing poverty.[196] Long-term studies of UBI programs are planned. The MIT Sloan School of Management plans a long-term study of the Kenya UBI program.[197] In addition to helping alleviate poverty, a main goal of the study is to provide solid information to policymakers.[198] The researchers hope the study answers questions such as: how will having a guaranteed income affect wealth, security, employment levels, efforts to find work, childcare health outcomes, and women’s empowerment? How will people use their time? Will more people pursue educational opportunities? Will there be any mental health benefits? Researchers at the Roosevelt Institute modeled three versions of unconditional cash transfers that could possibly be implemented in the US: “$1,000 a month to all adults, $500 a month to all adults, and a $250 a month child allowance” and found that all versions would result in improved economic growth, even if funded by increasing federal debt.[199]

While a UBI could meet people’s minimum survival needs, research has not yet shown how a UBI could meet the other psychological needs that work meets. UBI also has a dark side: Silicon Valley’s support for UBI could be explained as a way to keep people consuming their products even as those products take away people’s jobs.[200] Work, particularly decent work, can support social and emotional needs.[201] The next few subsections will explore how existing and new policies could help encourage employment and job creation.

B. Enhancing EITC

The earned income tax credit (EITC)[202] is a refundable tax credit first added to the IRC in 1975.[203] Intended initially as a temporary tax benefit to provide financial assistance to working families with children, it has been expanded over the years and now is one of the US government’s largest anti-poverty programs.[204] The EITC is pertinent to the discussion of how to deal with job displacement from automation mainly because it is an anti-poverty program. Congress decided to make the EITC permanent in 1978, with the stated purpose of reducing cash welfare payments.[205] In 1993, Congress extended the EITC to childless workers and increased the amount of the EITC based on family size.[206] With the expansion of the EITC came concerns about fraud, and subsequent legislation addressed those concerns.[207] In 1975, a little more than 5 million tax filers received the EITC.[208] In 2014, more than 25 million tax filers received the EITC.[209] The total dollars distributed by the EITC in 2014 exceeded $60 billion.[210]

The EITC equals a fixed percentage (depending on family size) of earned income up to a maximum amount ($18,660 for a single taxpayer with one child in 2018).[211] Once that maximum amount is reached, the EITC percentage phases down and fully phases out at a 2018 income of $40,320 for a single taxpayer with one child.[212] Earned income is defined as wages, tips, net self-employment income and other compensation included in gross income.[213] Recipients may not have investment income in excess of $3,500.[214] The maximum EITC payment to an eligible family with three or more children in 2018 was $6,431.[215]

While the EITC has been effective at reducing poverty in the US,[216] the program has faced challenges.[217] In particular, the complexity of the credit leads to taxpayers making inadvertent errors which lead to either overpayment or underpayment of the credit.[218] Researchers note that “EITC overpayments often result from the interaction between the complexity of the EITC rules and the complexity of families’ lives.”[219] For example, in Cowan v. Comm’r, the state of Ohio appointed Ms. Cowan to be the guardian of a child, Marquis, from 1991 until 2004.[220] Under state law, the guardianship automatically terminated when Marquis turned 18, which occurred in 2004. However, Ms. Cowan continued to provide Marquis a home and provided his support after he turned 18, and they continued to regard themselves as a family unit. Later, Marquis had a daughter, and they both lived with Ms. Cowan. The court found Ms. Cowan provided most of the household’s support during 2011. In 2011, Ms. Cowan claimed Marquis’s daughter as her granddaughter for the EITC. The court disallowed this claim since Marquis’s daughter was not a qualifying child of Ms. Cowan for purposes of the EITC, regardless of the fact that Ms. Cowan cared for Marquis’s daughter as her own.

Despite the stories about ineligible people claiming the EITC, over 20 per cent of eligible taxpayers fail to claim the EITC. In addition to the complexity of the EITC leading to inadvertent errors, it does not directly lead to employment. Rather, it makes employment more affordable for both employees and employers. Workers benefit by receiving a government transfer in the form of a refundable credit. A 2013 report noted that the fast-food industry, in particular, benefits from the EITC as well as other taxpayer subsidies.[221] Even critics of the report noted that “[b]y boosting the supply of potential low-wage workers, the [EITC and child care subsidies] can put downward pressure on pay, indirectly benefiting employers who depend on less-skilled workers.”[222]

In September 2018, former presidential candidate Senator Bernie Sanders introduced a bill to tax large employers whose employees rely on taxpayer funded social safety net programs, such as supplemental nutritional assistance program benefits, school lunch programs, and Medicaid.[223] The proposal would impose a tax of 100 per cent of the “qualified benefits” received by employees of employers with at least 500 employees. The short title of the proposal, the “Stop BEZOS Act”, indicates one of the target employers, Amazon. If enacted, the bill would also apply to retailers such as Walmart and much of the fast-food industry.[224] The bill does not include the EITC in the list of “qualified benefits”. Critics of the bill argued that while it is well-intentioned, it would result in fewer jobs for low-income Americans.[225] The proposal would likely result in employers seeking to avoid hiring workers who are eligible for such benefits or discourage employees from seeking public benefits.[226] The critics note that while the problem of stagnant wages and companies shifting employment costs to the federal government is real, there are better ways to solve the problem, including enhancing the availability of the EITC.[227]

C. Providing Jobs

Erik Brynjolfsson and Andrew McAfee, authors of The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies, advocate increasing the size of the EITC and making it universal.[228] Unemployment can be considered a market failure.[229] According to Professor Thomas Kochan, “[employers] benefit from minimizing their own labor costs while society picks up the tab for their lack of investment in human capital: slow economic growth, unemployment, welfare, and so on.”[230] Kochan called for a compact between business, labour, and government to create high-quality jobs that provide adequate compensation, training opportunities, and employee representation.[231] However, government action can correct market failures even in the absence of such a compact.[232] Tax policy can correct market failures and broader employment can lead to positive externalities: reduced crime, more investment, and stronger communities. However, the EITC is not a perfect fit for the problem of unemployment. While the EITC lifts workers out of poverty and encourages them to look for jobs,[233] there is no evidence that the EITC directly creates jobs.[234]

Government could provide incentives to private employers to create jobs. From 1977–78, the federal New Jobs Tax Credit (NJTC) was a broad-based incentive designed to help spur recovery after a recession.[235] The NJTC provided the credit to firms in which employment rose by more than 2 per cent and paid up to half of the first $4,200 in wages for each newly hired employee. Analysis indicated that while the NJTC may have “substantially affected some firms, most firms either did not know about the program or were not influenced by it.”[236] Therefore, the researchers concluded that “traditional monetary and fiscal policies are better suited to dealing with cyclical problems,”[237] like recessions. However, Congress tried this approach again in 2010, enacting the Hiring Incentives to Restore Employment (HIRE) Act, which provided a tax credit for hiring individuals who were unemployed or entering employment from outside the labour force. Unlike the NJTC, the HIRE Act did not explicitly limit the incentive to hiring in growing businesses, and therefore was viewed as less successful at job creation.[238] More recently, the federal Work Opportunity Tax Credit (WOTC) provides up to 40 per cent of the first year wages paid to employees in certain targeted groups who have traditionally faced barriers to employment, including veterans, ex-felons and Supplemental Nutrition Assistance Program recipients.[239] States also provide job creation tax incentives, as detailed by the National Conference of State Legislatures.[240] Targeted hiring credits may stigmatize the intended beneficiaries in the eyes of employers who may be reluctant to hire employees considered to be risky, damping the effects of the credits.[241]

Government itself could directly create jobs, thus avoiding some of the inefficiency of using tax credits for private employers. Some in Congress propose reinstating the Civilian Conservation Corp (CCC), which employed about two million men between 1933 and 1942.[242] The CCC workers built roads, trails (including the Appalachian and Pacific Crest Trails), and structures. A new CCC could address both the long-term unskilled unemployment problem and the backlog of deferred maintenance in the National Parks, Forest Service, and Bureau of Land Management.[243] The CCC was “wildly popular” during its existence, and many of the roads, trails, and structures built by the CCC are still in use today. As with the original CCC, the new CCC could incorporate training programs that would not only provide skills to workers, but also opportunities for skilled workers to be instructors.

D. Funding Solutions

In theory, the solutions described above could be funded in any way, whether by a robot tax, a consumption tax, a wealth tax, or simply by increasing marginal tax rates on the wealthy. However, equalizing the taxation of capital and labour income could both provide funding and assist in solving the robot jobs problem.[244] In 2013, Mary Louise Fellows and Lily Kahng argued for eliminating the tax preference for dividends and capital gains, theorizing that the US tax system overtaxes workers and undertaxes business owners.[245] Fellows and Kahng counter the classic economics theory that capital should be lightly taxed by showing that investing in workers would enhance economic growth.[246] Peter Drucker, the management “guru”, noted that “the most valuable asset of a 21st-century institution … will be its knowledge workers and their productivity.”[247] Beyond eliminating tax preferences for capital income, Fellows and Kahng proposed allowing deductions for workers’ costs of preparing and maintaining their capacity to remain productive, such as the cost of education, healthcare and childcare.[248] In a more recent article, Kahng questioned whether the tax distinction between capital and labour income is even meaningful, given that intellectual capital created from labour is an increasingly large portion of the economy.[249]

The Tax Reform Act of 1986 taxed capital and ordinary income at the same rate, raising revenue for reducing tax rates overall.[250] Although the parity in capital and ordinary rates didn’t last long, it did not result in economic chaos. Many tax games involve transforming ordinary labour income into low-taxed capital income, including the long-running “carried interest” ambit of private equity firms.[251] Taxing capital and ordinary income at the same rates would provide an element of much needed simplification to the US tax system,[252] in addition to increasing revenue and eliminating the preference for robot labour.

Rather than making the politically difficult change to the tax system of taxing capital gains at the same rate as ordinary income, a more limited way to achieve tax parity between robot labour and human labour would be to classify robot labour as “labour” rather than as “capital”. This would involve greater administrative complexity, as robot labour would need to be defined and earnings from such robot labour would need to be tracked through to the business owner and taxed as ordinary income. The tax shelter games facilitated by the disparity between capital and ordinary income would continue.

An even more modest solution would be to eliminate accelerated bonus depreciation and expensing provisions, which have been substantially expanded in recent years.[253] Restoring a reasonable depreciation schedule that approximates the useful life of the robot (rather than immediate expensing) would go a long way toward reducing the tax benefits of automation.[254]

Finally, taxing robots could provide revenue for job creation. While taxing robots to provide relief for humans whose jobs were lost because of automation has a pleasing symmetry, it is not a simple solution to the problem. To tax robots, one must first define robots, which can be an issue, as noted by New York University Business School professor Robert Seamans.[255] He wrote that “[t]axing investment in a handful of states based on an arbitrary definition of what does or does not comprise a ‘robot’ does not seem to be good policy.”[256] Lawrence Summers, former Treasury Secretary, former International Monetary Fund Chairman, and former president of Harvard University, wrote that taxing robots is illogical because they are wealth creators.[257] Summers views robots and automation as technological progress, and suggests that “staving off progress is a poor strategy for helping less-fortunate workers.”[258] Economist Thomas Straubhaar bluntly assessed the idea of taxing robots, writing that “taxing robots would be shooting oneself in the foot.”[259] He argued that taxing robots would slow technological progress and impair the competitiveness of workers, as jobs might not be lost to robots but to foreign competitors making use of robots, thereby harming “the very people [the policy] claims to protect.”[260] In the international tax context, a robot tax would impact plans to combat base erosion and profit shifting (BEPS).[261] One of the OECD’s goals in its BEPS project is to tax value where it exists.[262] It is hard to know where a robot’s value exists; whether it is in the hardware or software algorithms.[263] Therefore, it would be difficult to design and implement a way of assigning profits to a particular robot or automation program. Professor Orly Mazur also noted the significant difficulties in designing a robot tax, including the problem of determining how many human workers a robot has displaced and how to differentiate between job-enhancing and job-replacing robots.[264]

An article in the Economist sees the problem differently: rather than robots taking human jobs, the problem is “superstar firms” reaping outsized profits from their market power.[265] Noting that the labour share of income has been falling for decades, the author finds that “as machines displace humans in production, their incomes will face the same pressures that afflict human income.”[266]

Despite these difficulties, robot taxes have their proponents. As noted in the introduction, Bill Gates is a prominent advocate.[267] Robot taxes have been seriously considered by the European Union (EU)[268] and South Korea.[269] The EU ultimately abandoned the idea.[270] South Korea’s proposed “robot tax” would reduce an existing tax incentive for automation.[271] Professor Xavier Oberson, while acknowledging the definitional difficulties, proposed creating a “tax personality” for robots, calling them “electronic persons”.[272] He noted that this is not a new idea—corporations are legal entities that have tax personalities.[273] Robots have the capacity to generate income, and therefore have “ability to pay”, a known pre-requisite for taxation.[274] Professor Oberson also discussed the international tax aspects of taxing robots, noting introducing a tax on robots or on the use of robots would be a major global development requiring a coordinated approach, as risks of double taxation, double non-taxation, transfer pricing, aggressive tax planning or tax avoidance, could be exacerbated.[275]

As noted previously, the US tax system contains preferences for automation. Researchers from the University of Surrey note that a robot tax could provide neutrality between automation and human workers, thereby creating the right economic signal to businesses.[276] They propose several solutions including phasing out corporate deductions if a reported level of automation exceeds a specified threshold,[277] imposing a corporate “automation” tax if layoffs are determined to be related to automation,[278] and creating offsetting tax preferences for employing human workers.[279]

Whether taxing robots is a good idea or not, it will not happen unless there is political will to do so.[280] Economist Robert Shiller proposed a robot tax as a temporary measure, to ease the transition to a more automated economy.[281] Shiller viewed a robot tax as a means of addressing income inequality in a more politically palatable way than raising taxes on high-income individuals to redistribute to lower-income individuals.[282] As Shiller noted:

It may be more politically acceptable, and thus sustainable, to tax the robots rather than just the high-income people. And while this would not tax individual human success, as income taxes do, it might in fact imply somewhat higher taxes on higher incomes, if high incomes are earned in activities that involve replacing humans with robots.[283]

Conclusion

Powerful forces are behind the rise of automation. While few corporate executives will admit it, they want to automate as much as they can to drive short-term profits.[284] At the same time, human rights groups like the United Nations Human Rights Council find that automation, and artificial intelligence in particular, poses human rights issues.[285] If automation shifts the labour market such that large numbers of people cannot find jobs, they will be unable to maintain an adequate standard of living.[286] A recent article noted that automation is splitting the US workforce in two, describing the situation as a small island of highly educated well-compensated professionals in a sea of less educated workers in businesses that stay viable primarily by keeping wages low.[287]

Similarly, the US tax system raises human rights concerns. The United Nations Special Rapporteur on extreme poverty and human rights Philip Alston visited the US in December 2017, during the consideration for the tax reform that ultimately became the TCJA. He commented that the proposed tax reforms created an “enormous impetus … to income and wealth inequality.”[288] He also noted the explicit reference to welfare reform as a source of revenue and an “illusory emphasis on employment” which assumes that “there are a great many jobs out there waiting to be filled by individuals with low educational standards,” while at the same time workers in those jobs cannot survive on a full-time wage without government assistance.[289]

This article has taken a human perspective on the issue of automation. As described, automation creates two types of problems: a revenue problem and a jobs problem. The current tax system bases revenues primarily on human wages. Sooner or later, significant tax reform will be needed to address the coming clash between revenues and automation. Taxing robots is not a fruitful avenue for tax reform. Aside from the problem of defining robots, absent a worldwide tax, the capital investment in robots would likely move to countries without a robot tax. Rather, creating parity between the taxation of capital and labour would both increase revenues and reduce tax gaming. Recent proposals to increase taxes on the super-wealthy would also generate revenue from those who have profited from automation.[290] The revenues gained could be used to enhance the potential of human labour via education and job creation. Humans need good jobs for self-esteem and social interaction. Society needs to reduce income and wealth inequality. Tax reform could satisfy both needs.

[1] See Kevin J Delaney, “The Robot That Takes Your Job Should Pay Taxes, Says Bill Gates”, QUARTZ (17 February 2017), online: <qz.com> [perma.cc/Q29R-EDWY].

[2] See 157 US 429 (1895).

[3] See Kimberly Clausing, “Labor and Capital in the Global Economy”, Democracy 43 (Winter 2017), online: <democracyjournal.org> [perma.cc/77MN-448S].

[4] See AH Maslow, “A Theory of Human Motivation” (1943) 50:4 Psychological Rev 370 at 372–76.

[5] See generally Greg Harman, “Driverless Big Rigs: New Technologies Aim to Make Trucking Greener and Safer”, The Guardian (24 February 2015), online: <www.theguardian.com> [perma.cc/SD78-GVKC].

[6] See US, National Renewable Energy Laboratory, Estimated Bounds and Important Factors for Fuel Use and Consumer Costs of Connected and Automated Vehicles (NREL/TP-5400-67216) (November 2016) at 19, online (pdf): <www.nrel.gov>

[perma.cc/9PYE-649T].

[7] Pub L No 115-97, [2017] 131 Stat 2054 at § 12002(b)(3) [TCJA].

[8] Speaker of the House, Press Release, “Speaker Ryan’s Floor Remarks on the Tax Cuts and Jobs Act” (19 December 2017), online: <www.speaker.gov > [perma.cc/F8U8-4Q22].

[9] Thomas D Griffith, “Progressive Taxation and Happiness” (2004) 45:5 Boston College L Rev 1363 at 1366.

[10] See Julia Driver, “The History of Utilitarianism” in Edward N Zalta, ed, The Stanford Encyclopedia of Philosophy, Winter 2014 ed (Stanford, CA: Metaphysics Research Lab, 2014), online: <plato.stanford.edu> [perma.cc/AMG7-VQJG].

[11] See Selin Kesebire, “When Economic Growth Doesn’t Make Countries Happier”, Harvard Business Review (25 April 2016), online: <hbr.org> [perma.cc/W9H8-7BB9].

[12] See Andrew E Clark & Andrew J Oswald, “Unhappiness and Unemployment” (1994) 104:424 Econ J 648 at 650–51.

[13] TCJA, supra note 7 at § 13001(a).

[14] See Scott A Hodge, “The Jobs and Wage Effects of a Corporate Rate Cut”, Tax Foundation (25 October 2017), online: <taxfoundation.org> [perma.cc/C9KZ-P3JS].

[15] See ibid.

[16] See Bob Bryan, “Gary Cohn Had an Awkward Moment When CEOs Appeared to Shoot Down One of the Biggest Arguments for the GOP Tax Plan”, Business Insider (14 November 2017), online: <www.businessinsider.com> [perma.cc/ED5L-96Z6].

[17] See TCJA, supra note 7 at § 13201.

[18] This advertisement from a robotic welding manufacturer makes the point: “As much as you hate to admit it, employees can sometimes be unreliable—they don’t show up for work or have bad days. Robots are reliable—they are there everyday and can work numerous hours without taking a break or stopping for lunch.” Lincoln Electric, “Justifying the Cost of a Robotic Welding System”, online (pdf): <www.lincolnelectric.com> [perma.cc/L5LT-6FKM].

[19] See McKinsey Global Institute, “A Future that Works: Automation, Employment, and Productivity” (January 2017) at 45, online (pdf): <www.mckinsey.com> [perma.cc/

79QC-BQVK].

[20] See TCJA, supra note 7 at § 11049.

[21] See ibid at § 11045.

[22] John F Kennedy Presidential Library and Museum, News Conference, “News Conference 24”, (14 February 1962), online: <www.jfklibrary.org> [perma.cc/UUD6-75F4].

[23] See Richard Conniff, “What the Luddites Really Fought Against”, Smithsonian Magazine (March 2011), online: <www.smithsonianmag.com> [perma.cc/536A-JQXC].

[24] See Delaney, supra note 1.

[25] See ibid.

[26] See Chris Meserole, “What is Machine Learning?”, (4 October 2018), online: Brookings Institute <www.brookings.edu> [perma.cc/9P29-RNQB].

[27] See Anit Snir et al, “The Origin of Cultivation and Proto-Weeds, Long Before Neolithic Farming” (2015) 10:7 PLoS ONE 1, DOI: <10.1371/journal.pone.0131422>.

[28] See John H Moore, “The Ox in the Middle Ages” (1961) 35:2 Agricultural History 90.

[29] See BJ Lewis, JM Cimbala & AM Wouden, “Major Historical Developments in the Design of Water Wheels and Francis Hydroturbines” (Paper delivered at the 27th IAHR Symposium on Hydraulic Machinery and Systems, 2014) IOP Conference Series: Earth & Environmental Science 22 at 1.

[30] Unfortunately, the cotton gin just cleaned the cotton, but did not pick it. See Joan Brodsky Schur, “Eli Whitney’s Patent for the Cotton Gin” (23 September 2016), online: National Archives <www.archives.gov> [perma.cc/YZX3-HCET].

[31] See John Steele Gordon, “How the Industrial Revolution Began”, Barron’s (13 February 2015), online: <www.barrons.com> [perma.cc/M6B5-2JGJ].

[32] See ibid.

[33] See Kat Eschner, “One Hundred and Three Years Ago Today, Henry Ford Introduced the Assembly Line: His Workers Hated It” Smithsonian Magazine (1 December 2016) online: <www.smithsonianmag.com> [perma.cc/44CB-25QY].

[34] See Michael Urquhart, “The Employment Shift to Services: Where Did It Come From?” (1984) 107:4 Monthly Labour Rev 15 at 16.

[35] See ibid. The Washington Post provided an animated and more detailed picture of the shift in the United States, by state, from 1990 to 2014: see Reid Wilson, “Watch the U.S. Transition from a Manufacturing Economy to a Service Economy, in One Gif”, Washington Post (3 September 2014), online: <www.washingtonpost.com> [perma.cc/

U7VS-8DRL].

[36] See US Bureau of Labor Statistics, “Employment by Major Industry Sector” (24 October 2017), online: United States Department of Labor <www.bls.gov> [perma.cc/VD5M-2SLH] (Figures exclude special industries, and therefore percentages do not add to 100).

[37] See Federica Cocco, “Most U.S. Manufacturing Jobs Lost to Technology, Not Trade” Financial Times (2 December 2016), <www.ft.com> [perma.cc/WC2R-D93G].

[38] See Christoph E Boehm, Aaron Flaaen, & Nita Pandalai-Nayar, “Multinationals, Offshoring, and the Decline of U.S. Manufacturing” (2017) US Census Bureau Center for Economic Studies Working Paper No CES 17-22 at 3.

[39] See Michael J Hicks & Srikant Devaraj, “The Myth and the Reality of Manufacturing in America” at 6 (April 2017), online (pdf): Ball State University Center for Business and Economics Research <conexus.cberdata.org> [perma.cc/KY3N-PW3W].

[40] See Daron Acemoglu & Pascual Restrepo, “Robots and Jobs: Evidence from US Labor Markets” (2017) National Bureau of Economic Research Working Paper No 23285 at 36.

[41] See Scott Andes & Mark Muro, “Don’t Blame the Robots for Lost Manufacturing Jobs” (29 April 2015), online: Brookings Institution <www.brookings.edu> [perma.cc/KQJ2-7GSK].

[42] See ibid.

[43] See ibid.